Powerful UK consumer finance classification, data profiling & market segmentation

Fresco is CACI’s powerful individual-level financial segmentation. To build it, we’ve combined data from the IPSOS Financial Research Survey with CACI’s own wealth of data on the UK population.

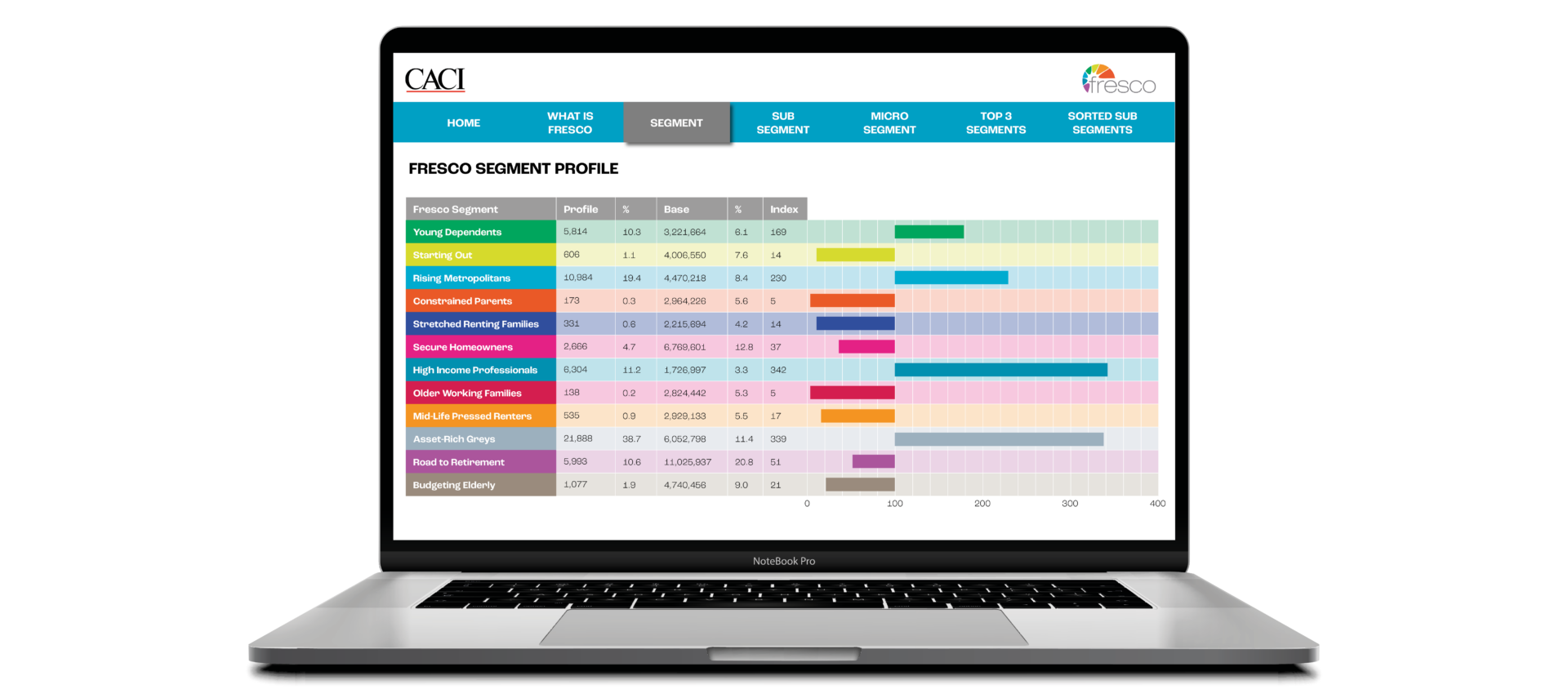

Fresco divides the UK into 12 segments and 52 sub-segments. They’re based on an individual’s life stage, affluence, finance, product holdings, channel usage and attitude to money. Our Fresco dataset gives you a universal vocabulary to describe your customers, prospects and the market.

Fresco is defined as a gold standard classification within the financial services sector. That’s because Fresco can divide UK consumers into discrete, clearly defined and easy-to-understand groups.

Discover more about Fresco services

Download our Fresco datasheetTalk to the Fresco team

Speak to one of our data services experts to discover how you can improve your customer experience.

Fresco FAQs

What is Fresco?

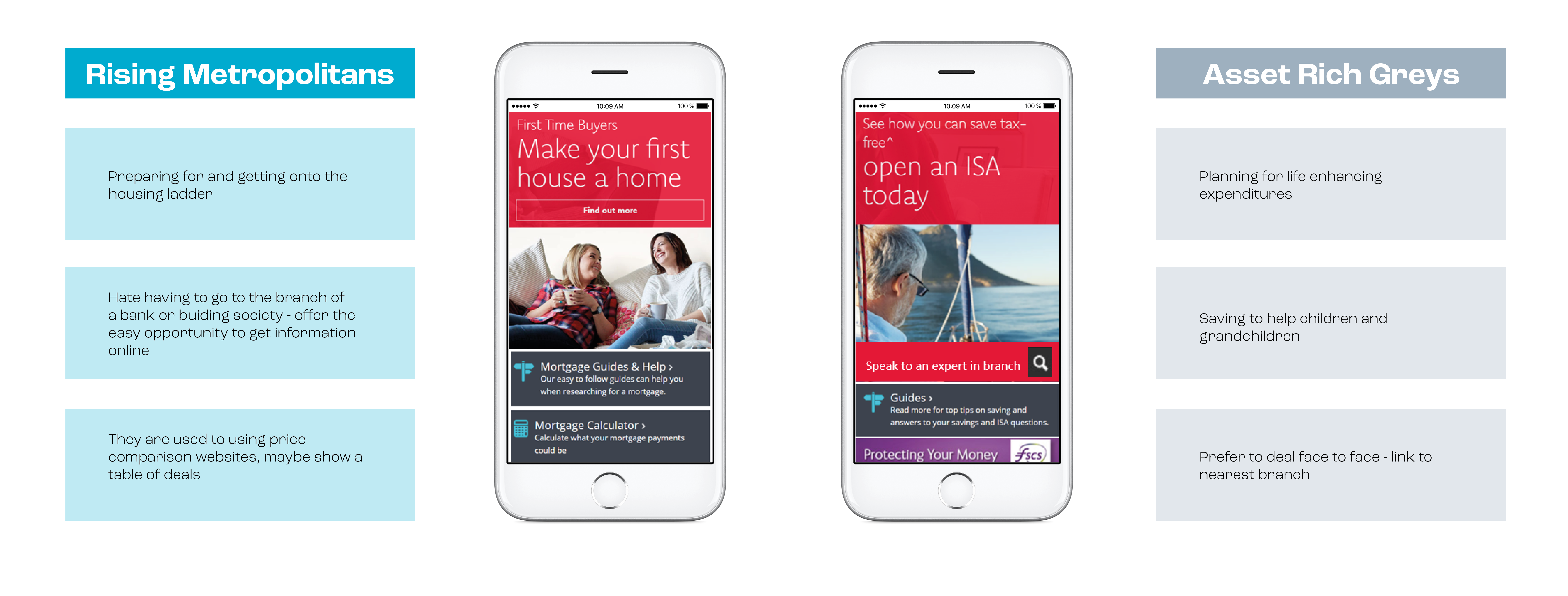

Fresco is a powerful financial services segmentation tool produced by CACI that categorises individuals within a household based on their financial behaviour. It considers factors such as life stage, affluence, financial product purchases and holdings, channel preferences and attitudes.

Why choose Fresco?

Using Fresco provides you with numerous benefits. Fresco uses high-quality research data and classifies individuals, not just households. Fresco also provides regular updates and enhances coding accuracy by tailoring to your data. This financial segmentation tool can be accessed in real-time to support decision-making and enhance user experiences.

What are the features of Fresco?

Fresco combines the comprehensive data from IPSOS’s Financial Research Survey with CACI’s extensive demographic and lifestyle datasets. This integration combines multiple dimensions to create a single segment code at the individual level. This powerful segmentation tool can be applied to your customers and benchmarked against the market, supplying valuable insights and understanding.

What data insights can Fresco segmentation provide?

Using Fresco as a segmentation tool provides valuable data insights across various dimensions. It offers information on income and affluence, financial product holdings, channel usage and preference, lifestyle and life stage characteristics, credit behaviour, financial attitudes, savings and investments, house values and tenure, as well as digital and technology behaviours. By analysing these factors, Fresco enables businesses to comprehensively understand individual financial behaviours and preferences, empowering them to make informed decisions and tailor their strategies accordingly.